REAX

https://reax.pro

SolidityTelos EVMReactTypeScriptDIA Oracle+5 more

RXDex

Building a Capital-Efficient AMM for Synthetic Assets

Project Overview

Transforming vision into reality

Client Information

Organization

REAX

Website

reax.proProject Timeline

Start Date

October 2023

Completion

September 2024

Duration

11 months

Project Overview

A comprehensive case study detailing ChainScore Labs' development of RXDex, an innovative Automated Market Maker (AMM) protocol designed specifically for synthetic assets on the REAX ecosystem. We engineered a flexible platform with capital-efficient liquidity pools, offering minimal slippage and reduced impermanent loss compared to traditional DEXs. The protocol features stable and variable pools, single-sided liquidity provision, veREAX yield incentives, and advanced risk management systems to ensure optimal trading and liquidity experiences while maximizing capital efficiency.

INTRODUCTION

Reimagining AMMs for Synthetic Assets

Traditional Automated Market Makers (AMMs) face significant challenges when applied to synthetic assets, including capital inefficiency, high slippage, and substantial impermanent loss. RXDex was conceived to address these limitations by creating a specialized AMM protocol designed specifically for the unique properties of synthetic assets in the REAX ecosystem. This case study details how ChainScore Labs engineered a flexible, capital-efficient liquidity protocol that optimizes the trading and liquidity provision experience for synthetic assets. By implementing custom pool designs with specialized mathematics and incentive structures, we've created an ecosystem where users can trade with minimal slippage and provide liquidity with reduced impermanent loss risk, all while maintaining the composability that makes DeFi powerful.

POOL-ARCHITECTURE

Specialized Pool Architecture

RXDex features a multi-pool architecture with specialized designs for different asset classes and trading requirements. Each pool type implements custom mathematics and parameters to optimize for specific trading scenarios and user needs.

- Stableswap Pools: Engineered specialized pools for stable synthetic assets that use curve-based mathematics to provide deep liquidity near the peg while minimizing slippage for large trades between assets of similar value.

- Variable Pools: Implemented traditional constant product pools with enhanced features for volatile synthetic assets, optimized to balance trading efficiency with acceptable impermanent loss levels.

- Weighted Pools: Designed flexible weighted pools that allow custom token ratios, enabling optimized exposure to synthetic assets based on market demand and strategic requirements.

- Hybrid Pool Innovations: Created innovative hybrid pool designs that combine elements of multiple pool types to address specific trading needs across the synthetic asset ecosystem.

4+

Pool Types

Specialized for different assets

Customizable

Pool Parameters

Per pool type requirements

Optimized

Trading Efficiency

For synthetic assets

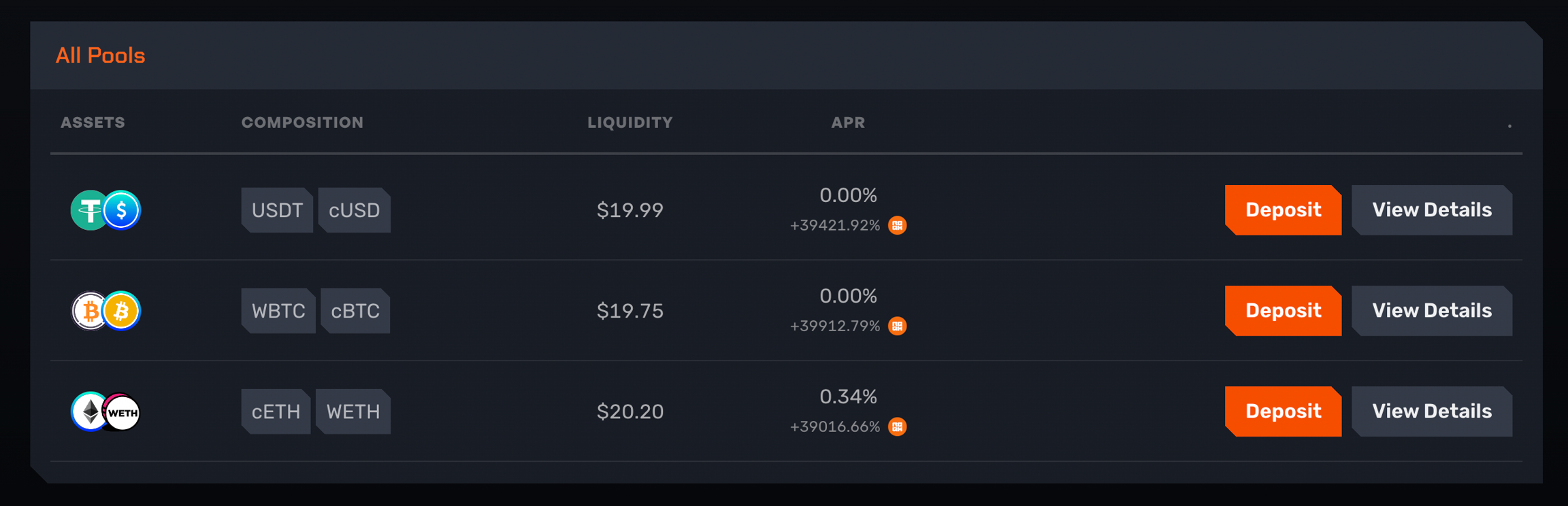

RXDex Pool Selection Interface

LIQUIDITY-PROVISION

Flexible Liquidity Provision

RXDex revolutionizes the liquidity provision experience by offering multiple options designed to accommodate different user preferences and risk profiles. These flexible entry points make it easier for users to participate in liquidity pools without the traditional complexity.

- Single-Sided Liquidity: Implemented innovative mechanisms allowing users to provide liquidity using just one token in the pool, automatically balancing the position internally to reduce friction and lower barriers to entry.

- Multi-Asset Deposits: Supported traditional balanced deposits of multiple assets, optimized to reduce slippage during the deposit process and maintain pool stability during large liquidity events.

- Dynamic Deposit Routing: Created intelligent routing that analyzes deposit composition and pool conditions to minimize slippage and optimize the deposit path for maximum capital efficiency.

- Position Management Tools: Developed comprehensive tools for monitoring and managing liquidity positions, giving users clear visibility into performance metrics and simplified rebalancing options.

Multiple

Deposit Methods

For different user needs

Minimized

Entry Friction

Through single-sided options

Comprehensive

Position Metrics

For informed decisions

RXDex Liquidity Deposit Interface

VETOKEN-INCENTIVES

veREAX Yield Incentives

Aligning Long-term Participation

RXDex implements an innovative yield incentive system centered around the veREAX token, designed to reward long-term liquidity providers and align incentives across the ecosystem. This mechanism creates sustainable liquidity while giving participants governance rights.

- LP Token Staking: Engineered a staking mechanism for liquidity provider tokens that unlocks additional yield through protocol fees and emissions, encouraging users to maintain their positions for longer periods.

- Vote-Escrow Model: Implemented a vote-escrow system where users can lock REAX tokens for veREAX, gaining boosted yields, governance rights, and fee sharing proportional to their lock duration and amount.

- Yield Boosting: Designed dynamic yield boosting that amplifies returns based on veREAX holdings, creating a flywheel effect that rewards the most committed ecosystem participants.

- Gauge System: Created a flexible gauge system allowing veREAX holders to direct emissions to different pools, enabling community-driven incentive allocation based on perceived importance and utility.

- Fee Distribution: Implemented transparent fee distribution where a portion of trading fees is directed to veREAX holders, creating sustainable passive income for long-term participants.

RXDex LP Staking Interface

Multiple

Yield Sources

Trading fees, emissions, boosts

Flexible

Lock Duration

Up to 4 years

Up to 2.5x

Boost Potential

For maximum commitment

TRADING-EXPERIENCE

Optimized Trading Experience

RXDex delivers a superior trading experience optimized for synthetic assets, with a focus on minimizing slippage, providing accurate price information, and enabling efficient execution of both small and large trades.

- Smart Order Routing: Implemented intelligent routing algorithms that analyze multiple pools and paths to find the most efficient execution route for trades, minimizing slippage and maximizing output.

- Flash Swap Integration: Engineered flash swap capabilities that enable advanced trading strategies and arbitrage opportunities without requiring upfront capital, increasing overall market efficiency.

- Price Impact Visualization: Developed clear price impact indicators that give traders transparent information about the expected slippage for their trades, enabling informed decisions about trade sizing and timing.

- MEV Protection: Implemented mechanisms to protect traders from maximal extractable value (MEV) attacks, reducing the risk of sandwich attacks and other harmful front-running practices.

Optimal

Route Options

For minimal slippage

Transparent

Price Impact

Clearly communicated

Maximized

Execution Efficiency

Through smart routing

RXDex Trading Interface

YIELD-FARMING

Comprehensive Yield Opportunities

RXDex provides multiple yield generation opportunities designed to reward different forms of participation while maintaining sustainable economics. The layered approach to yield creates compelling returns without risking protocol stability.

- Trading Fee Yield: Designed the core fee structure to direct a significant portion of trading fees to liquidity providers, creating sustainable, market-driven yield that scales with protocol usage.

- Emissions-Based Incentives: Implemented strategic token emissions to bootstrap liquidity in key pools, with emissions that adjust over time to balance immediate incentives with long-term token sustainability.

- Lockdrop Promotions: Created periodic lockdrop events that provide boosted initial rewards for users committing to long-term liquidity provision, accelerating pool depth for new synthetic assets.

- Yield Tracking Dashboard: Developed comprehensive yield monitoring tools that give users clear visibility into their current returns, historical performance, and projected earnings across all active positions.

Multiple

Yield Tiers

Based on commitment level

7-day trailing

APR Calculation

For realistic projections

Available

Compounding Options

For maximized returns

RXDex Yield Monitoring Interface

RISK-MANAGEMENT

Comprehensive Risk Management

Protecting Liquidity Providers and Traders

RXDex incorporates advanced risk management systems designed to protect users from the unique risks associated with synthetic asset trading and liquidity provision. These mechanisms help maintain protocol stability while safeguarding user funds.

- Impermanent Loss Mitigation: Designed specialized pool mathematics and incentive structures that reduce the impact of impermanent loss, particularly for stable asset pools where traditional AMMs suffer significant inefficiencies.

- Oracle Circuit Breakers: Implemented safety mechanisms that can temporarily pause trading during detected oracle price feed irregularities, preventing exploitation during periods of market instability.

- Gradual Parameter Adjustment: Created systems for careful adjustment of pool parameters like fees and weights, ensuring changes occur gradually to prevent disruption to existing liquidity providers and traders.

- Liquidity Concentration Controls: Developed mechanisms to monitor and manage liquidity concentration, preventing potential manipulation by large position holders while maintaining efficient price discovery.

- Risk Visualization Tools: Built intuitive interfaces that clearly communicate potential risks to users, including impermanent loss projections and other metrics to enable informed decision-making.

Real-time

Risk Monitoring

With automated alerts

Multiple

Safety Mechanisms

Layered protections

Gradual

Parameter Governance

For stability preservation

INTEGRATION-WITH-REAX

Seamless REAX Ecosystem Integration

RXDex is designed to work as a core component within the broader REAX ecosystem, with deep integrations that create a seamless user experience and enable powerful cross-protocol strategies.

- Synthetic Asset Flow: Developed seamless pathways for users to move between minting synthetic assets on REAX, trading them on RXDex, and using them as collateral on RXLend, creating a complete synthetic asset lifecycle.

- Shared Tokenomics: Implemented a unified tokenomics model where the REAX token and its escrowed variant (veREAX) provide coherent incentives and governance rights across all ecosystem protocols.

- Cross-Protocol Strategies: Enabled sophisticated multi-protocol strategies like leveraged liquidity provision and yield optimization that utilize the unique capabilities of each protocol in the ecosystem.

- Unified Interface: Created a consistent user experience with shared design language and authentication across all REAX ecosystem protocols, reducing friction and cognitive load for users.

Comprehensive

Protocol Integrations

Across REAX ecosystem

Seamless

Cross-Protocol Flows

For unified experience

Multiple

Composable Strategies

Enabled by integration

Security Architecture

Protecting User Assets and Protocol Stability

- Formal Verification: Applied formal verification methods to critical pool mathematics and swap execution logic, mathematically proving the correctness of key functions to prevent unexpected behavior.

- Incremental Testing: Conducted extensive testing with incremental parameter adjustments to validate pool behavior under various market conditions, including extreme volatility and liquidity events.

- Sandboxed Deployment: Implemented a phased deployment approach with initial caps on pool sizes and gradual increases as security confidence grew, limiting potential impact during the early protocol lifecycle.

- Economic Simulation: Performed agent-based economic simulations to identify potential attack vectors or exploitable conditions, ensuring the incentive structure remained robust under various scenarios.

- Independent Security Audits: Engaged multiple specialized security firms to conduct thorough code audits before launch, with all identified issues addressed and verified through follow-up reviews.

- Governance Timelock: Implemented time-delayed governance actions to allow community review of proposed changes and provide window for emergency action if malicious proposals are detected.

- Emergency Shutdown System: Designed graduated emergency controls that can pause specific functions or trigger an orderly system shutdown if critical vulnerabilities or exploits are detected.

- Bug Bounty Program: Established an ongoing bug bounty program with significant rewards for identifying security vulnerabilities, incentivizing responsible disclosure from the security community.

Metrics

Roadmap and Future Vision

$5M+

Protocol TVL

Target for first quarter

$20M monthly

Trading Volume

Projected growth

Quarterly

New Features

Continuous innovation

Cross-chain

Ecosystem Expansion

Future development

Project Gallery

Visual showcase of our work

Explore the detailed implementation and user interface design that brings this project to life.

1 / 5

Start Your Journey

Ready to Create Something Amazing?

Let's discuss how we can help you achieve similar results with a custom solution tailored to your specific needs and goals.

Start Your Project Today

Book a 30-minute strategy session with our experts to discuss your project goals, timeline, and technical requirements.

Developed in collaboration with

REAX

100%

Success Rate

24/7

Support